Job-Überblick

19. Dezember 2023

28. Jänner 2024

PGIM Fixed Income | Senior Investment Analyst based in London

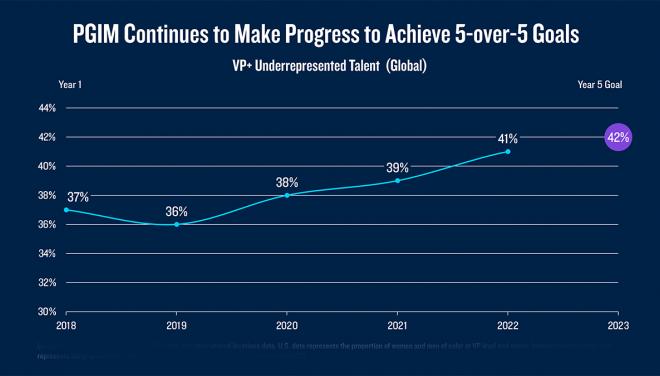

PGIM is the diversified asset management business of Prudential Financial, Inc. (NYSE: PRU). With $1.4 trillion in assets under management, and 38 offices spanning 16 countries, PGIM is among the world’s top-10 largest asset managers. Comprised of seven self-governing asset management divisions, each PGIM business offers a distinct workplace culture that aligns with the firm’s ultimate objective: to provide premier service to our clients while fostering an inclusive workplace culture that is rooted in trust, respect and equality.

Our Business: PGIM Fixed Income is a global asset manager offering active solutions across all fixed income markets. With over 1000 employees and $790bn assets under management as of 30 June 2022, the company has offices in Newark, London, Letterkenny, Amsterdam, Munich, Zurich, Tokyo, Hong Kong, and Singapore. Our business climate is a safe inclusive environment, centered around mutual respect, intellectual honesty, transparency and teamwork. Our leaders are focused on talent & culture; dedicated to fostering growth & development at all levels to develop the industry leaders of tomorrow.

Our Role: The Analyst role in the Portfolio Analysis Group (PAG) provides investment analysis, both portfolio and market based for the European High Yield desk, along with other key internal stakeholders and current/prospective clients. PAG Analysts deliver expert Quantitative Investment Analytics and work with internal stakeholders including portfolio managers, risk managers, traders, credit research, client service representatives and the sales and marketing team to deliver performance attribution and analytics; monitor portfolio positioning alignment and risk exposures; collect and analyse market data; and model portfolios and custom benchmarks, all within the various constraints that exist for the portfolios they cover.

The ability to successfully navigate multiple, and at times competing, ad hoc requests and projects simultaneously that relate to market or portfolio analytics received from different areas of the Fixed Income organization is key.

Aufgaben

- Dynamically monitor and assess portfolio positioning with respect to currency and credit risk exposures and thresholds, providing construction and alignment insight where possible

- Integrate specific client guidelines, objectives and risk tolerances into the firm’s investment process and strategies to ensure complete portfolio management and analytics are in place for our portfolios

- Follow developments, views and themes within the market and understand how these drive portfolio positioning and performance

- Maintain the Portfolio Analysis Group’s position as a world class provider of Investment Analytics and provide execution against the organization’s strategic goal set.

- Work with peers across mandates to ensure analytics processes and methodologies are applied consistently and efficiently

- Deliver and effectively communicate monthly and quarterly performance attribution analysis

- Work with others throughout the organization to ensure that the Portfolio Analysis Group, Portfolio Management teams and the Risk Management Group have the tools and technology required to effectively manage portfolios

- Compare and contrast various benchmarks and their risk and positioning profiles, assess appropriate benchmarking for given mandates or clients

- Remain current on all applicable technology related to portfolio analytics, attribution methodologies, modelling methodologies and risk management tools

- Construction of model portfolios based on client or prospect guidelines as well as modelling of impact of cash flows to existing portfolios

- Track new issues and spread levels

- Ad hoc Project work

Profil / Ihre Qualifikation / Ihre Persönlichkeit:

- 3-5+ years of experience in Fixed Income Investments and a demonstrated passion for Fixed Income Analytics

- Strong demonstrated quantitative skills (project experience involving data analysis a plus)

- Ability to thrive in a fast-paced environment while working on multiple tasks both independently and within a team construct

- Excellent verbal and written communications skills -

- Maintains high levels of productivity and self-direction

- Demonstrated skills as a team player and is also able to work independently

- Extensive experience with MS Excel and other technical data analysis / modelling tools

- Knowledge of Aladdin/SQL/Python/TableauVBA a plus

- Bachelor’s degree with concentration(s) in Finance, Economics, Mathematics or Engineering preferred or equivalent experience will be considered

- CFA or other applicable masters level work such as Statistics or Quantitative Finance or equivalent experience will be considered

- Embraces and encourages change and development

- Excellent attention to detail, accuracy and completeness

- Strong critical thinking and logic skills

- Enjoys problem solving

- excellent written and verbal communication skills;

- team player with high energy and a positive attitude;

- seeks development and learning opportunities;

- proficient use of technology applications through suite of Office 360 applications;

- Aladdin and Salesforce experience beneficial;

- Strong critical thinking and logic skills;

- Embraces and encourages change and development;

- Maintains high level of productivity and self-direction;

- Enjoys being a part of a team but can work independently

- Proactive in solution solving

Das erwartet Sie

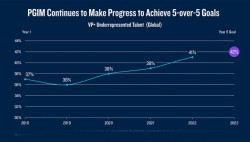

Prudential Financial, Inc. is focused on creating a fully inclusive culture, where all employees feel comfortable bringing their authentic selves to work. We don’t just accept difference—we celebrate it, support it, and thrive on it. At Prudential, employees have a unique opportunity to build their career path by owning their development, their career and their future. We encourage employees to hone their skills and explore continued opportunities within Prudential.

Prudential is a multinational financial services leader with operations in the United States, Asia, Europe, and Latin America. Leveraging its heritage of life insurance and asset management expertise, Prudential is focused on helping individual and institutional customers grow and protect their wealth. The company's well-known Rock symbol is an icon of strength, stability, expertise and innovation that has stood the test of time. Prudential's businesses offer a variety of products and services, including life insurance, annuities, retirement-related services, mutual funds, asset management, and real estate services, some of which may not be available in your area.

We recognize that our strength and success are directly linked to the quality and skills of our diverse associates. We are proud to be a place where talented people who want to make a difference can grow as professionals, leaders, and as individuals. Visit www.prudential.com to learn more about our values, our history and our brand.

Bewerbung

Prudential is an equal opportunity employer. All qualified applicants will receive consideration for employment without regard to race, color, religion, national origin, ancestry, sex, sexual orientation, gender identity, national origin, genetics, disability, marital status, age, veteran status, domestic partner status , medical condition or any other characteristic protected by law.

We look forward to receiving your application.

Diese Anzeige auf LinkedIn teilen →Standort

Grand Building, 1-3 Strand, UK-WC2N 5EJ London

Galerie

Job vergeben:

true